Instant Shipping Insurance Quote

All-Risk Coverage in a Few Simple StepsInstant, Automated ‘All-Risk’ Coverage for Parcel, Freight & Marine Cargo.

Skip the paperwork and secure comprehensive protection in minutes, not days.

Coverage Starts at $2.95

How it Works: Your Steps to Instant Coverage

1. Get Your Instant Quote

- Enter the value of your shipment

- Cover your product value and shipping cost

- Insure up to $500,000 per shipment

2. Tell Us About Your Shipment

- Enter your product, shipping and address details

- Domestic and International coverage

- Full coverage across Truck, Ocean, and Air

3. Confirm & Get Covered

- Secure your coverage in one single click

- Certificate is instantly and uploaded to your account

- Full financial backup for loss, theft or damage

Why Businesses Trust ShipSimple for Shipping Insurance

"So simple... took about 2 minutes,

such a great easy, efficient system!"

![]()

✅ High Coverage Limits

✅ Fast, Hassle-Free Claims

✅ Automated Certificates

– Sarah K.

✅ Up to $250K (Parcel) $500k (Freight) Coverage – 20x the courier / carrier limits.

✅ Domestic and International Shipment Protection

✅ Minimize Loss, Maximize Recovery – Avoid costly setbacks from damage or loss.

✅ Multi-Courier / Carrier Coverage – Insure shipments with all major couriers

✅ Fast, Easy Claims – Get payouts quickly — no red tape.

✅ Flat, Low Premiums – No deductibles for parcel. Predictable, business-friendly pricing.

✅ Build Customer Confidence – Show your customers you take shipping seriously.

✅ Backed by the Best in the Business – We partner with CNA, one of the largest U.S. commercial insurers serving Canada, the U.S., and Europe. Your shipments are protected by an elite, globally trusted name in insurance.

✅ Industry-Leading Coverage & Financial Strength – Rated “A” by AM Best and A by Standard & Poor’s, our policies reflect the strongest financial stability in the insurance world. That means your payouts are reliable, fast, and safe.

All Risk Shippers Interest Insurance

ShipSimple specializes in All-Risk Shipper’s Interest Insurance, which is a comprehensive type of parcel, cargo / freight shipping insurance designed to protect the shipper’s (cargo owner’s) financial interest in their goods during transit, regardless of who is at fault for loss or damage.

Here’s what it means to you:

“All-Risk” Coverage: This is the broadest form of protection available. Essentially, it covers all physical loss or damage to your goods from any external cause, unless that cause is specifically excluded in the policy. Common exclusions usually involve things like improper packaging, acts of war, government seizures, or inherent defects in the goods themselves.

“Shippers Interest”: This part is key. It means the policy directly protects you, the owner of the cargo. This is a big difference from the basic insurance a carrier (like a trucking company or shipping line) has. A carrier’s liability insurance typically only pays out if they were negligent, and often has very low limits. Shippers interest insurance, however, pays you directly, regardless of who was at fault, and usually covers the full declared value of your goods.

ShipSimple Freight Insurance vs. Standard Carrier Liability

Don’t let unexpected losses derail your business. While standard carrier liability offers minimal protection, ShipSimple provides comprehensive, stress-free insurance designed for the modern Canadian business, covering your goods across land, ocean, and air.

Feature |

ShipSimple |

Standard Carrier Liability |

Why This Matters for Your Freight |

Coverage Limits |

Up to $250,000 for Parcels. Up to $500,000 for Freight | Typically $100 – $500 (parcel), $2/lb – $25/lb (freight) | Financial Risk: Your business bears the brunt of losses beyond these minimal limits, regardless of how your goods travel. |

Coverage Type |

All-Risk Shipper’s Interest (Covers Most Perils) | Limited Perils (Covers only specific, few events) | Peace of Mind: “All-Risk” covers far more scenarios, protecting against theft, damage, loss, and more, across all transportation methods. |

Deductibles |

None for Parcel | Often Applicable | True Value: No hidden costs eating into your reimbursement, whether for a small package or a large cargo. |

Claim Process |

Fast, Easy, No Red Tape! | Slow, Complex, High Burden of Proof | Business Continuity: Get back on track quickly with our streamlined process, minimizing downtime across your entire supply chain. |

Proof Required |

Simple Online Reporting | Extensive Documentation & Investigation | Time Saved: Focus on your business, not endless paperwork, regardless of the shipment type. |

Payer |

Backed by CNA (A-rated Global Insurer) | Carrier (Internal Process) | Reliability: Confident in secure, timely payouts from an industry leader, for any type of shipment. |

Applicability |

Covers All Major Carriers/Couriers | Limited to Specific Carrier/Couriers | Flexibility: Use your preferred carriers (land, ocean, or air) while maintaining consistent, high-level protection. |

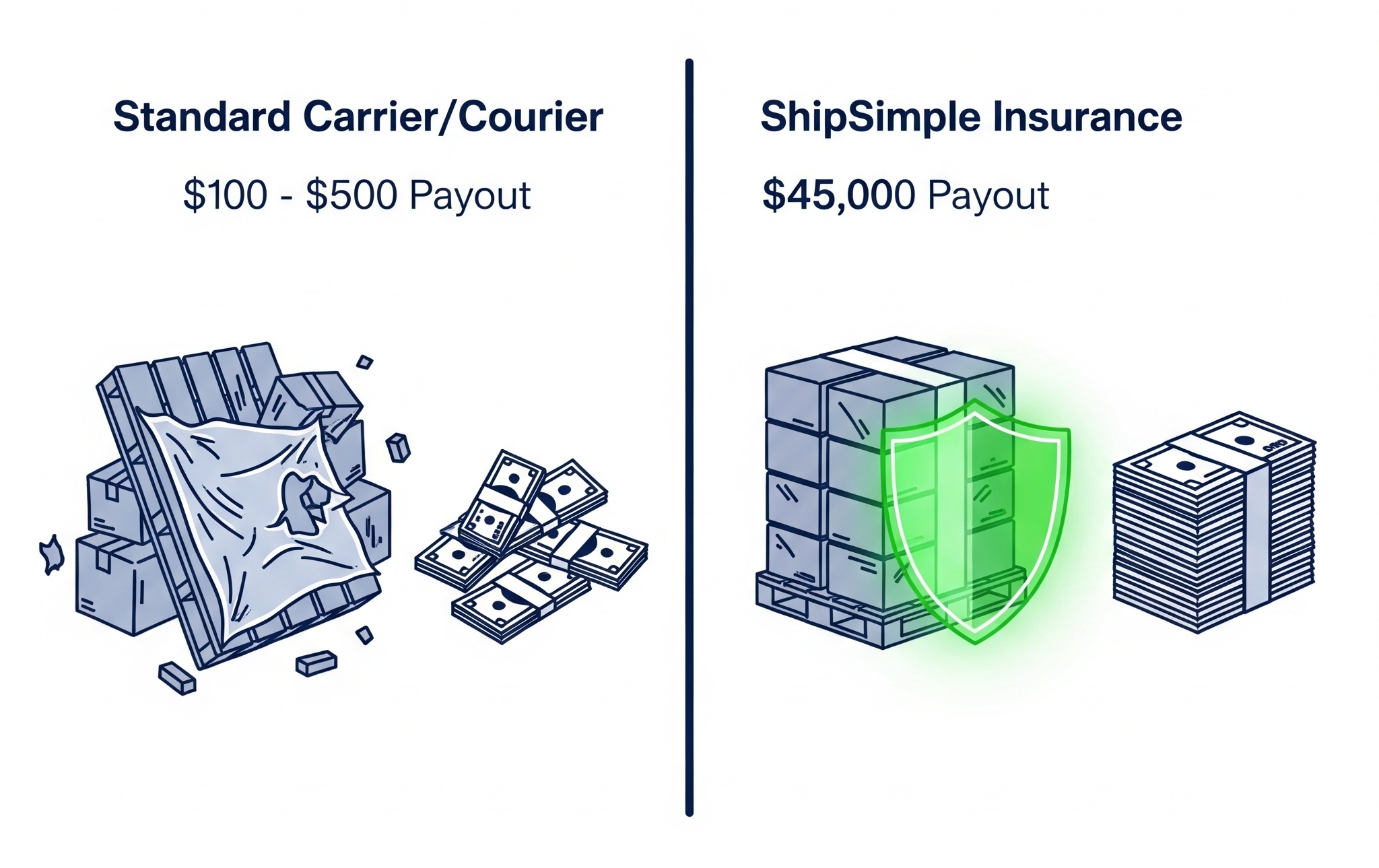

Cost-Benefit Analysis: The Value of Shipping Insurance

- With ShipSimple Shipping Insurance: Your payout would be the full $45,000 (minus any applicable deductible), ensuring full financial recovery.

- With Standard Carrier Liability: A total loss of a $45,000 shipment would result in a payout of as little as $100 to $500, leaving your business to absorb a catastrophic loss of over $44,500.

Helping Businesses grow across Canada

5 Star Reviews

Speak for themselves — check out what other businesses are saying!

Protect Your Shipments,

Protect Your Bottom Line

Blog

The 5 Hidden Risks of International Shipping (And Why Carrier Liability Isn’t Enough)

The Reality of International Shipping: Why Your Cargo Is at Risk Global logistics is a modern miracle, but for the package itself, it is a gauntlet of risk. When you hand off an international shipment, you are sending your inventory into a complex, high-friction...

Get All-Risk Shipping Insurance: The 7-Point ShipSimple Advantage

You have done the essential, foundational research. You’ve journeyed from understanding the gauntlet of hidden risks in shipping to a definitive, head-to-head comparison of your protection options. You now know, with absolute certainty, that comprehensive "All-Risk...

Carrier Liability vs All-Risk Insurance: The 7-Point Definitive Comparison

In our previous guide, we uncovered the hidden financial risks of shipping. You learned that the default "coverage" offered by carriers is not true insurance, but a system of limited liability that can leave your business exposed to devastating losses. You've had the...